How to migrate Uniswap v2 liquidity to v3?

Nov 30, 2021

Select your Uniswap v2 DEPAY LP position

Head over to https://app.uniswap.org/#/migrate/v2

Make sure your wallet containing the UNI-V2 LP tokens is connected

The site will autodetect your existing liquidity positions

Select your Uniswap v2 DEPAY/ETH LP that you want to migrate to v3

Select your DEPAY/ETH fee tier on v3

We recommend you to select the 0.3% fee tier for your Uniswap v3 DEPAY/ETH position

"The 0.30% fee tier is best suited for less correlated token pairs such as the ETH-DAI token pair, which are subject to significant price movements both to the upside and downside. This higher fee is more likely to compensate LPs for the greater price risk that they take on relative to stablecoin LPs." *Source: Official guide by Uniswap

Select your price range for liquidity provision

Next, select the price range your provided DEPAY/ETH liquidity shall be "active" in.

The more precisely (or "narrowly") you can estimate this range, the higher your potential rewards due to trading fees. Because of the more efficient use of liquidity, providers of small amounts of liquidity (but narrow range of their liquidity provision) can earn more than some of those with large amounts of liquidity but a large a price range spread. In Uniswap v2, your liquidity was spread over the full price range (zero to infinity) by default.

From the official Uniswap v3 docs

"When making a price range decision, LPs should consider the extent to which they think prices will move over the course of their position's lifetime and their willingness to actively manage their positions (and all the costs associated with more active management)." *Source: Official guide by Uniswap

Also good to know:

"If the price moves outside of the LP's specified range, their position will be concentrated in one of the two assets and not earn trading fees until the price returns to their range." *Source: Official guide by Uniswap

Allow/Approve the migration contract

Approve the Uniswap v3 migration contract to be allowed to spend your LP tokens

Wait until the approval is confirmed

Check the summary of your liquidity migration

Actual Migration

Hit "Migrate" or "Add" in order to migrate your liquidity to Uniswap v3

"After the 'add' transaction has been confirmed, LPs can find and manage their new positions on the 'Pool' page." *Source: Official guide by Uniswap

Advanced Buying & Selling Strategies on Uniswap v3

Selling DEPAY with Take Profit Orders

With a Range Sell Order (or: Take Profit Order), you add DEPAY/ETH (single sided liquidity pair with 100% DEPAY and 0% ETH) to Uniswap v3. You define in which price range (from price x to price y) your tokens should be exchanged for ETH. If the current market price exceeds your defined y price, your total liquidity is now 100% in ETH. You can liquidate this position at any time.

It may sound a bit confusing reading this the first time. Once you start conquering it, you can set up amazing buying- & selling strategies for your portfolio!

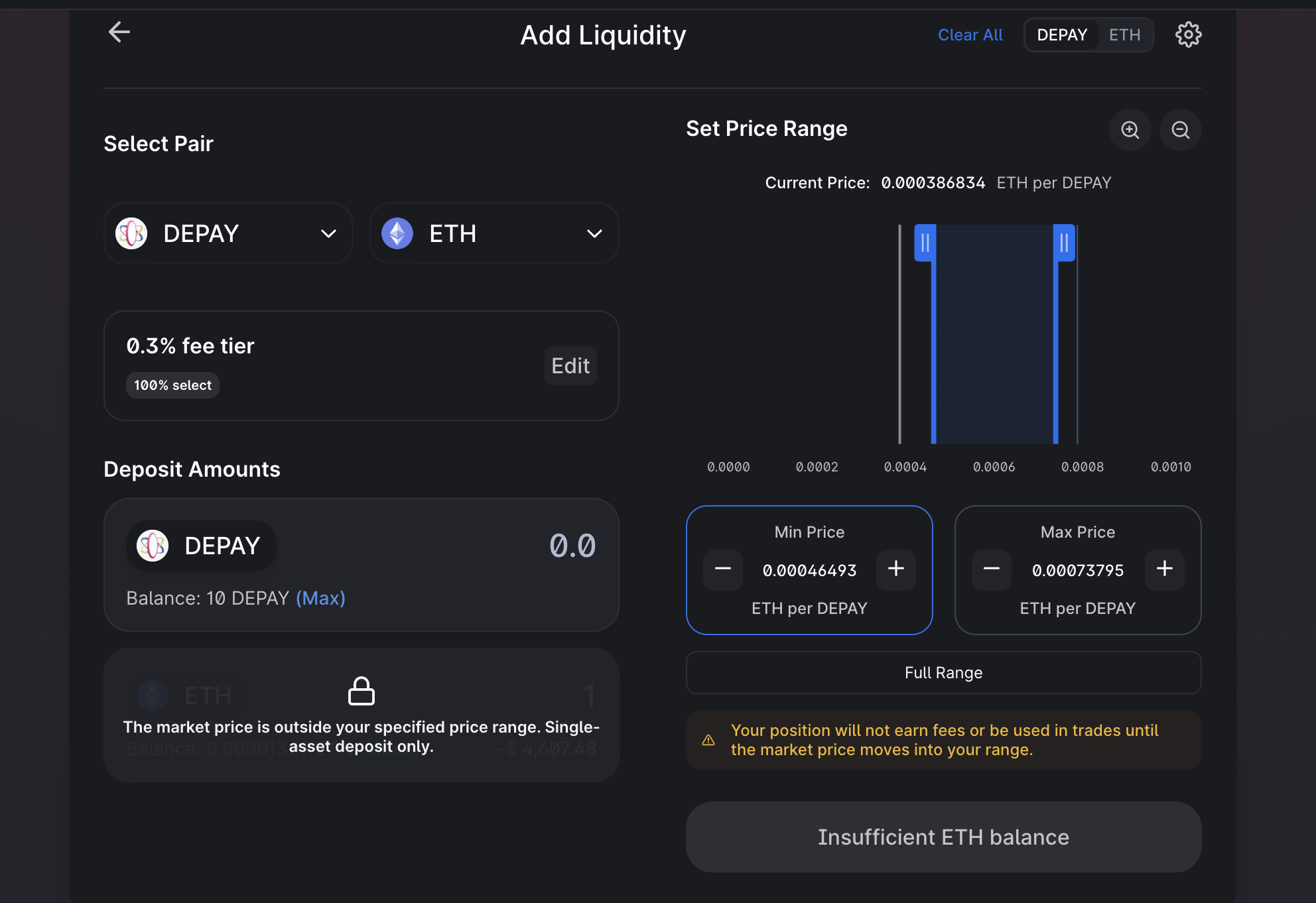

Please have a look at the following example:

Explanation: If you move the sliders to the "right of spot price" area, you will automatically only have the option to add DEPAY as LP. If the spot price moves to the right beyond your maximum price, your liquidity will be consisting of 100% ETH. If the price is exactly halfway between your minimum and maximum price, your position will be 50% DEPAY and 50% ETH.

Buying DEPAY with Buy Limit Orders

The principle in this case is the same as selling, but you create a single-sided DEPAY/ETH pair with 100% ETH and 0% DEPAY.

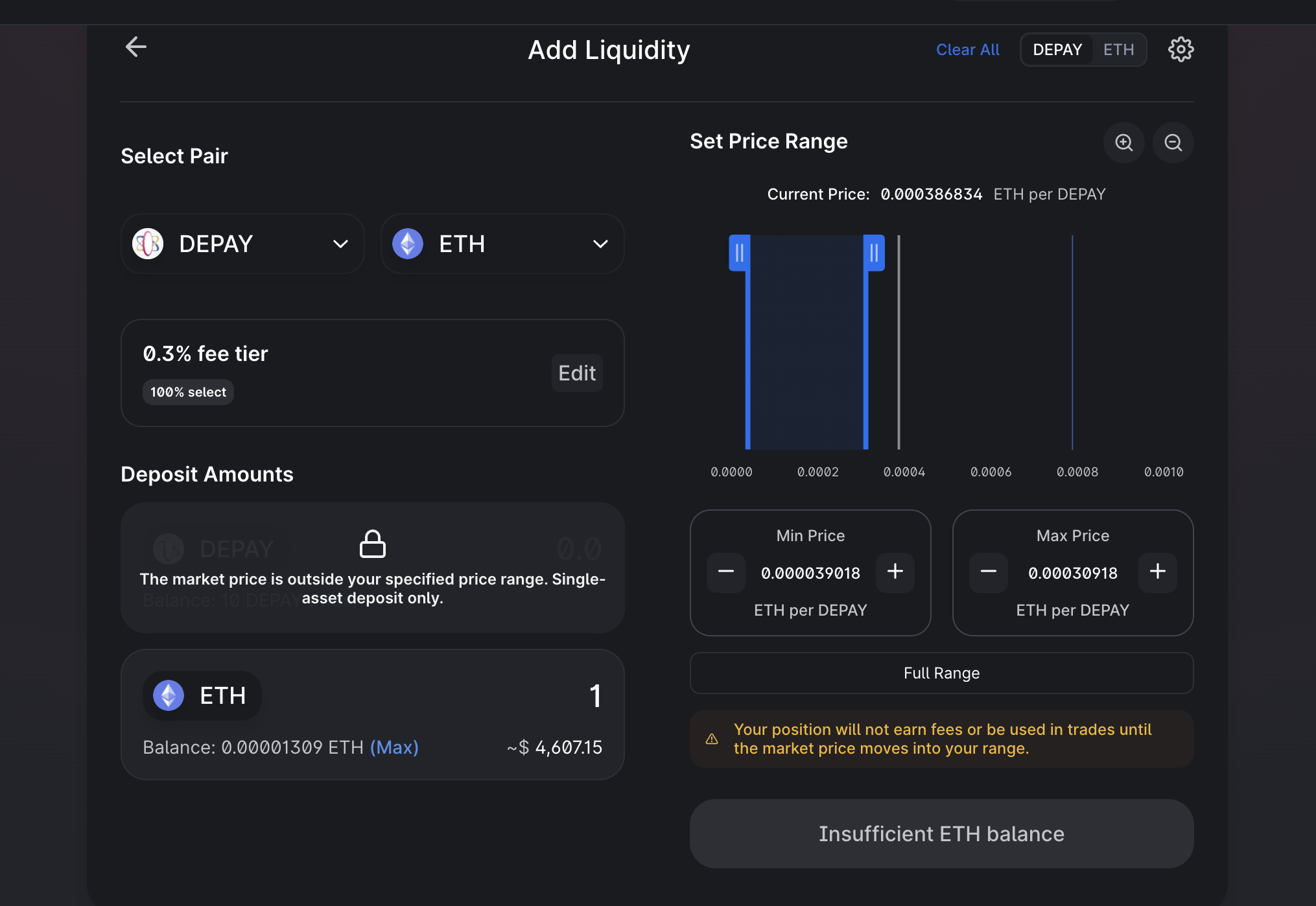

Same example as above, just reverted:

Explanation: If you move the sliders to the area left to the spot price, you will automatically only have the option to add ETH as LP. This means: Your provided ETH will be exchanged with DEPAY in your defined area. If the spot price moves to the left beyond your minimum price, your liquidity will be consisting of 100% DEPAY. If the price is exactly halfway between your minimum and maximum price, your position will be 50% DEPAY and 50% ETH.

Still insecure?

If you are still not sure if migrating to Uniswap v3 makes sense for you, please read our eye-opening article about the advantages and opportunities Uniswap v3 offers compared to v2.

The article demonstrates why v3 is way more attractive than the previous version, especially for LP's.

*Source: https://help.uniswap.org/en/articles/5391553-migrate-liquidity-from-uniswap-v2-to-v3