Product Lineup

Nov 21, 2020

This is the next finished chapter in our whitepaper: the product lineup.

We gave this a lot of thought, and we are thrilled to release all of it over the next 4 years, but let's head straight into it.

DePay Payments

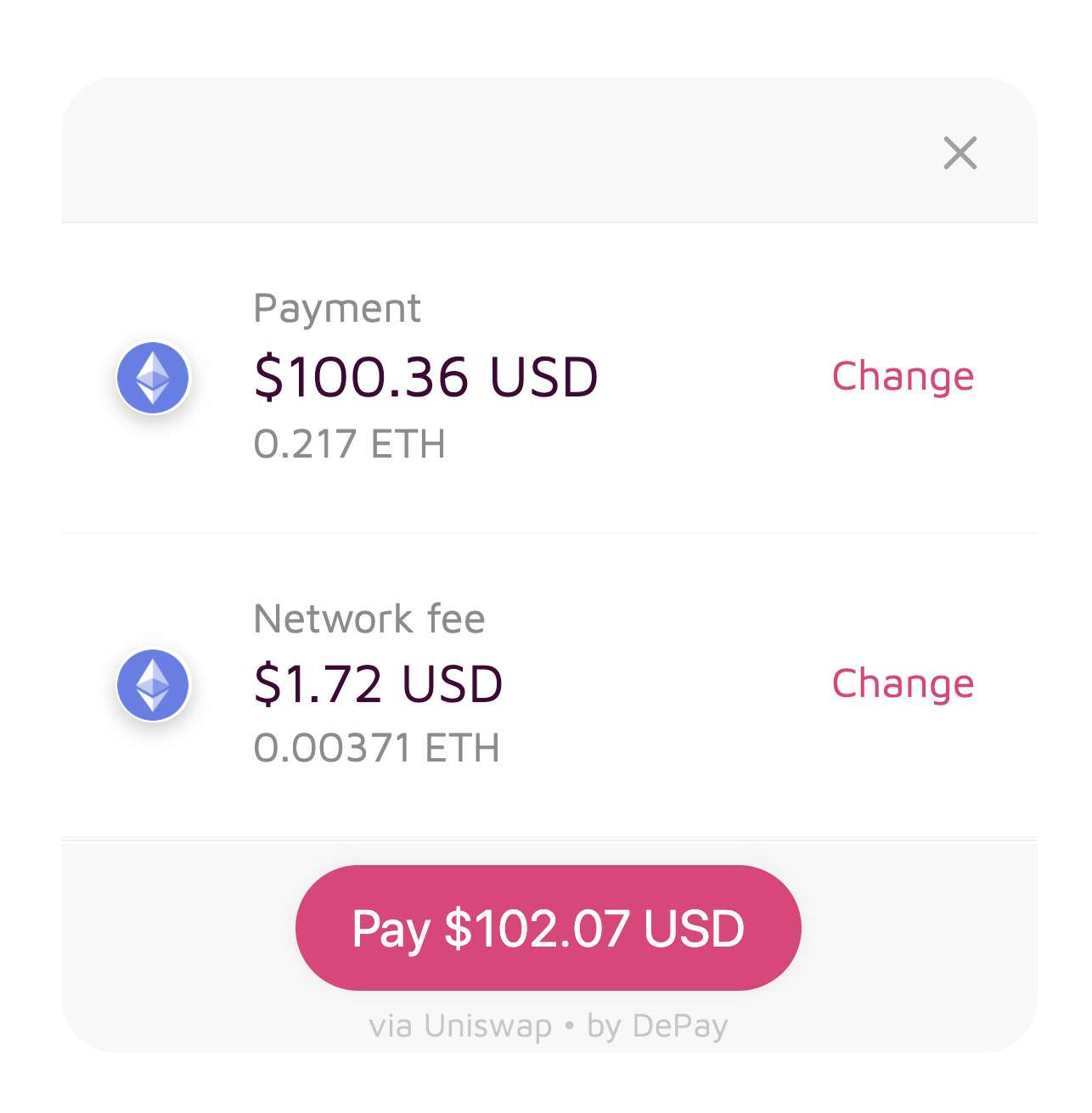

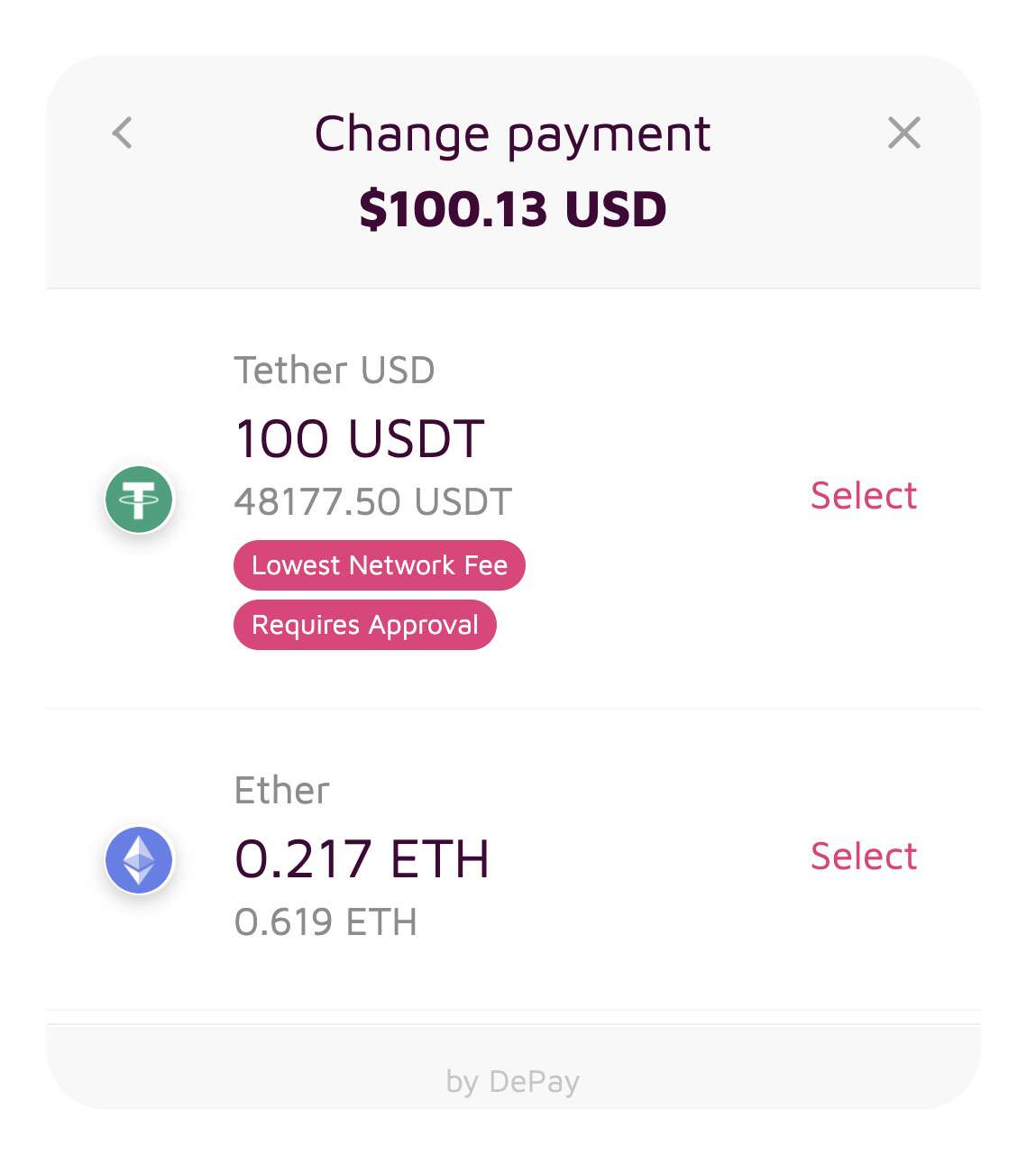

When it comes to receiving payments within the decentralized web, the DePay Payment solution is unmatched and a leader in the industry. For both buyers and sellers, the solution is easy to use and seamless to integrate. For sellers it allows any crypto token to be requested as payment, and for buyers, it will continuously scan and calculate the most cost-effective way to make a payment using the tokens in the buyer's wallet.

For example, where a seller requests to receive 100 USDT for a service or product, the buyer would only need to use the DePay Payment button. Once executed, the widget will automatically scan the buyer’s wallet for all exchangeable assets of value.

Should the wallet not contain the required amount of USDT but contain a sufficient amount of ETH, the widget will automatically suggest using ETH instead.

The DePay Payment Protocol (the smart contract) would then automatically swap the buyer’s ETH to USDT and then send the requested 100 USDT to the seller. All of this happens in a single, real-time transaction.

As long as there is a decentralized exchange pair or decentralized market maker with enough liquidity for the individual assets, the payment will work with all combinations: ETH/ETH, TOKEN/TOKEN, ETH/TOKEN, and TOKEN/ETH.

Whilst the initially suggested route is the most cost-effective (as calculated by the widget), the user is not obliged to use the suggested option. The widget will also allow users to select any other exchangeable asset within their wallet as a means of payment.

DePay TokenSale

The DePay Payment components also provide other common use cases. DePay’s scan and cost-effective routing can also be utilized by DApps to sell tokens to users directly.

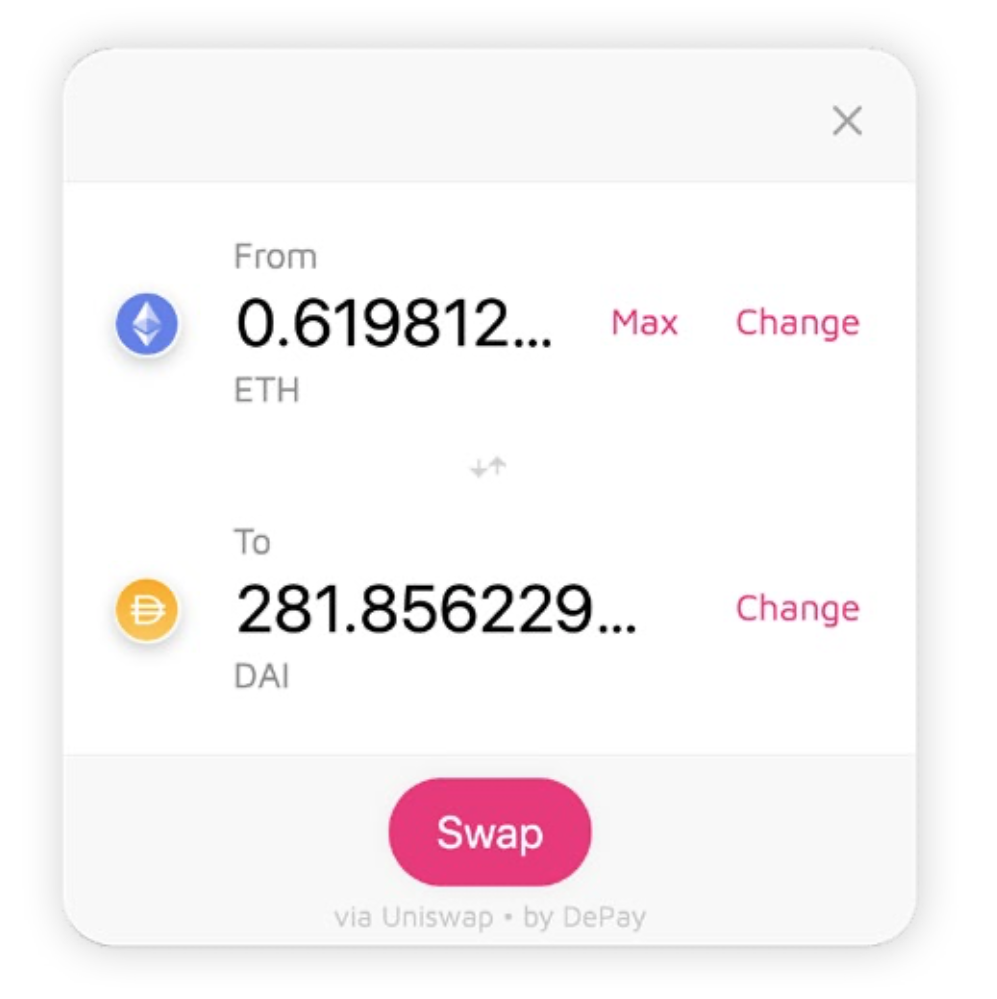

DePay Swap

Similar to DePay TokenSale, DePay Swap is another version of DePay’s scan, routing, and cost-efficiency technologies. DePay Swap will be delivered as a standalone browser plugin in the future, but can also be used by other DApps to allow exchanging crypto-assets as part of their application.

DePay Subscriptions

Performing manual recurring payments as part of an ongoing subscription can become a tedious task.

In order to remediate this problem, DePay plans to launch a dedicated product to handle subscriptions based on payment streams. This will provide sellers with a simple solution to easily facilitate decentralized subscription payments between them and their customers.

When DePay subscription streams are being executed they make use of DePay’s smart contracts to ensure cost-effective crypto asset exchange.

As an example, a seller may want to receive 100 USDT per month from customers for continuous access to their product or service. A customer who selects that subscription model could select to make payments in DAI instead of USDT each month. Thereafter, every time the seller executes his different subscriptions, they will be routed through the DePay payment protocol and converted accordingly into USDT where required.

DePay Wallet

DePay plans to fully integrate the previously mentioned products into a payment-focused crypto wallet. The development and distribution of the DePay Wallet makes sure that the usage of DePay’s protocols and basic products are not dependent on DApp developers’ efforts to onboard DePay within their applications.

As an example, the DePay Wallet will allow users to make use of the DePay Payment widget even on DApps or websites which have not integrated DePay themselves. This is achieved by detecting that the user plans to perform a blockchain payment and offer the most cost-effective payment option.

DePay Payroll

Payrolls are an important part of the economic cycle of monetary value. For that reason, DePay will also launch a payroll product on top of decentralized payment streams which will allow payroll specific contractual attributes and configurations to be manifested and executed on the blockchain.

With DePay Payroll, employers can pay their employees on a recurring basis with a crypto asset of their choice when payment is routed through DePay’s payment protocol. Similarly, employees have the ability to receive the equivalent payment amount in a crypto asset of their choice.

DePay Credit

Subscriptions and payrolls are payment streams. Certain attributes of those streams such as volumes and transaction history are stored on the blockchain.

Utilizing the above products, DePay plans to launch “uncollateralized” loan facilities by tokenizing subscription and payroll streams.

DePay PRO

In order to meet the demand for additional comprehensive and professional services within the payment space, DePay plans to roll out DePay PRO.

PRO is a subscription-based model that provides customers with access to all PRO services across the entire DePay product landscape.

In order to unlock PRO, users need to either pay (redeem) or hold (stake) DEPAY tokens.

The first PRO feature is a comprehensive payment dashboard that provides clients with an overview of all incoming payments, filter options, and payment search functionality (e.g. payments by specific client). Clients are also able to make use of graphs in order to analyze incoming payment volume over time.

Beyond the PRO payment dashboard, additional payment analytics and payment insight functionality will be developed. This will provide clients with access to various data sets relating to their customers (profiling data). Profiling data will include average wallet balances across various tokens together with average customer spend in conjunction with wallet size. This data will support clients in the analysis of their customer base, allowing them to efficiently manage their products and services.

Keeping track of client payments through the blockchain can be difficult for invoicing and financial reporting, both internally and externally (tax, accounting). As a result, PRO plans to offer invoicing capability together with data export functionality in order to support clients with their financial reporting needs.

Businesses often have requirements to integrate new tools within their existing solutions and workflows (e.g. Salesforce and other collaboration tools). In order to accommodate this, PRO will offer integrations and solutions to simplify work for businesses and their workforce.