The beginning of a new payment protocol

Oct 02, 2020

It is the year 2020 and it feels like almost everybody in the decentralized developer space is busy forking the fork of somebody else’s fork. Sushiswap forks Uniswap, Swerve forks Curve, all centralized exchanges copy decentralized exchanges. Don’t even get me started on all the food named yield protocols, which I wouldn’t even call forks but plain copycats with different packaging.

It seems like barely anybody understands the opportunities that lay right in front of us. Especially what is possible to build on top of all the liquidity protocols. When I entered the decentralized blockchain space, I’ve always imagined the entire shopping and payment experience to be more like in “Ready Player One”:

Turns out, actual trying to pay with some utility or payment token, is more like:

A lot of DApps out there, that have their own token, are overwhelmed trying to explain to users on how to either register & KYC at a centralized exchange or how to use a decentralized exchange in order buy their token, just so that users can then return to their DApp to pay with their token. Complicated? It is. No adoption? No wonder. A lot of DApps started allowing paying with ETH over their own token and asking for a surcharge when users do so. That basically just undermines the entire purpose of having an own token in the first place. You eliminate the demand for your own token, which was supposed to fund your project. People simply do it because the drop-off rate is too high. Trying to get users to buy your tokens before they can use your software is just too complicated. But that’s gonna change now.

Yes. Decentralized exchanges and liquidity protocols improved things a lot. In theory, you can now swap any asset into any other asset, as long as there is a liquidity pool for it. Does that mean it’s easier for the end-user? No. Try to explain to the average Joe how automated market makers work, or how the hyperbola shape affects the slippage of your swap.

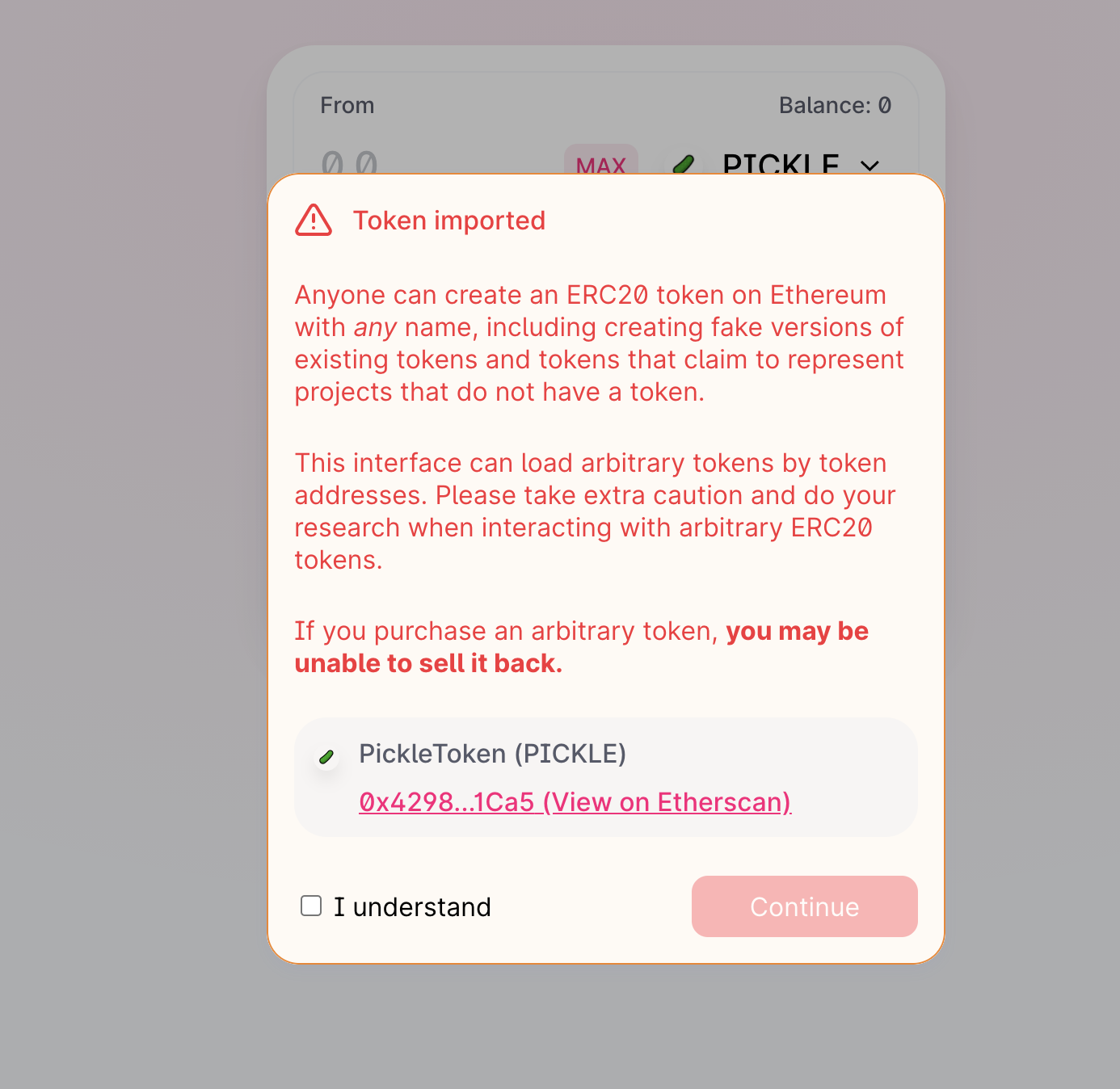

We all know how those eligible warning messages on decentralized exchanges are the right fit for a trader and a trader experience, but they are still not gonna allow DApps to create a good payment experience at the point of sale.

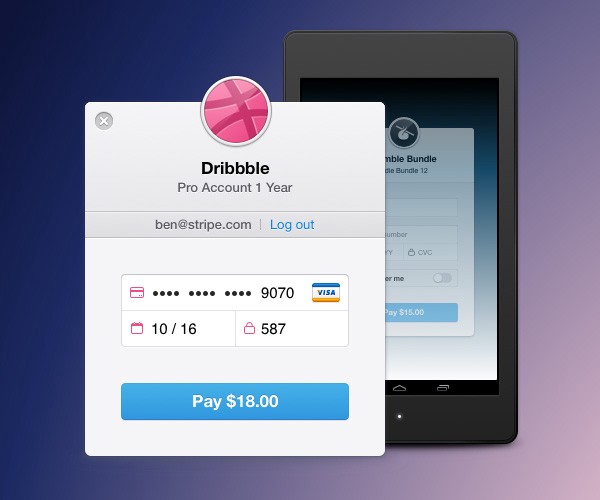

I like to quote my favorite innovator here: “You have to start with the customer experience and work backwards to the technology.” Let’s have a look at how things have been done in the “old world”. And with the “old world” I mean the centralized internet shopping experience with bank-licensed payment processors like Stripe. Stripe not only pushed the limits of how simple payment experience for a user can be. They also made it very simple integrate such an experience as a developer.

We at DePay, we want the same simple experience for decentralized applications. For users as well as for developers. So what’s stopping us to have the same thing for the decentralized web? Nothing. It just needs to be built first. And it’s gonna be.

I am glad to announce that DePay is gonna kickstart the work on a new decentralized payment protocol at the ETHOnline Hackathon.

We expect a working prototype of what we have been outlining in this article by the end of October 2020.

And that’s just gonna be the first step. While we plan to implement the outlined experience first on Ethereum. We know that we can only ensure and reach the desired end-user experience if we fully support all major blockchain and inter blockchain technologies out there. In the end, the user doesn’t know and does not want to deal with: What is Ethereum? Is this my Polkadot wallet? Am I paying with Hive right now? Is this an inter-blockchain? The end-user just wants to pay and move on. Follow us, if you want to be kept updated about our progress building a new decentralized payment protocol.