Uniswap v2 liquidity staking program

Dec 15, 2020

Our Uniswap v2 staking program has been discontinued (please read the announcement & ways to earn Uniswap v3 rewards as a LP here). This article has been kept for the archive.

💡 In case you are still DEPAY liquidity provider on Uniswap v2, feel free to check out our guide on migrating your Uniswap v2 liquidity to Uniswap v3!

DePay would like to afford everybody an equal opportunity to participate in our liquidity Stake & Earn program.

This article aims to provide comprehensive information about our staking program in order to educate interested participants.

The commencement of the program in December is deliberate, chosen to kick off just before our marketing madness month of January. This decision allows all current and early token holders to stake for the highest APY of the program whilst it still remains "under the radar".

You could call it an early Christmas present, so let's get it on *ho ho ho* 🎅 🎁

How can I participate in staking and earn up to 100% APY?

1. If you don't have any DEPAY tokens yet, go to Uniswap and buy DEPAY: Buy DEPAY on Uniswap

2. Next you need to add liquidity to the DEPAY/ETH pair on Uniswap (50:50 ratio): Add DEPAY/ETH liquidity on Uniswap

3. Stake your liquidity and earn DEPAY on our token page: Stake and earn DEPAY

What is staking?

In Crypto "staking" means to buy, hold, and lock in a certain asset class in order to participate in the network, community, or tokenomics and obtain a reward in return.

Under the DePay program, you would stake Uniswap liquidity tokens (UNI-V2) for the DEPAY/ETH pair in order to raise the overall liquidity of the DEPAY/ETH pair on Uniswap to a new high. This will allow us to enable larger trades on Uniswap given enhanced liquidity supporting a higher volume of trades with less price volatility. The end result of which would be to attract larger traders ("Crypto Whales") with more capital who would then place larger trades on DEPAY.

The above allows you to effectively become “your own bank” as you will become a liquidity provider and market maker, earning you DEPAY with your DEPAY by providing those functionalities.

Why liquidity and not plain token staking?

You often see crypto projects offer plain token staking. DePay does not consider plain token staking to be a win-win situation. In most cases, plain token staking is only performed to provide seed sale investors and start-up teams with an early exit strategy. Generally, those plain token staking programs do not even try to enable any additional functionality, ETH2 staking being the most prominent plain token staking example that actually does follow and enable a functionality "proof of stake".

In order to serve a function and actually generate value, we've decided on liquidity staking and not just plain token staking.

What will happen to my Uniswap liquidity while it's staked?

Whilst your Uniswap liquidity is staked it will earn you fees from every trade going through the DEPAY/ETH pair on Uniswap.

Liquidity providers on Uniswap earn a 0.3% fee on all trades proportional to their share of the pool.

Currently, our daily volume on Uniswap (according to Coingecko data) is: $170'000 USD average, $65'000 USD median, $5'500 USD low and $1'100'000 USD high.

Illustrative Example:

You add Uniswap liquidity of 1'000 DEPAY ($1.24) / 2.09668 ETH ($587), total value $2'480 USD (50:50 ratio at the time of lock-in)

You will own 1% of the pool (current pool size 99k DEPAY)

Considering the median trading volume of $65'000 USD the pool will earn $195 USD/day

1% of this will be your earnings: $1.95 USD/day

$711 USD/year

28.7% APY and this does not include staking rewards, yet

How many rounds of staking are there?

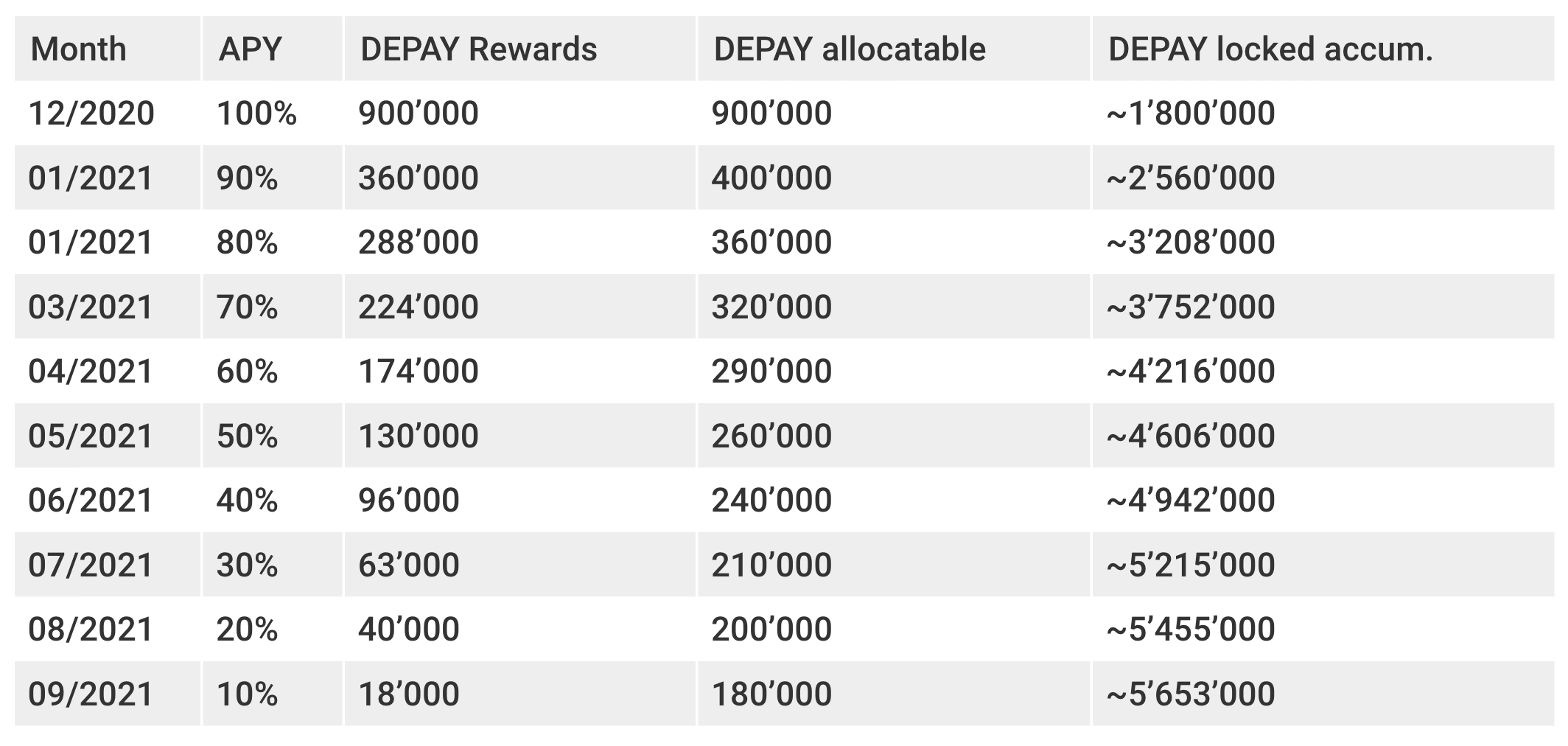

DePay will execute 10 rounds of staking, 1 round every month commencing with a short staking round in December 2020 (remainder of the month).

Each month the APY will decrease together with the associated rewards and limits for the DEPAY/ETH liquidity participation portfolio.

The aim is to lock a total of 5.6M DEPAY at the staking peak. The first set of staking rewards will unlock in 12/2021, with the final set unlocking in 09/2022.

Unused DEPAY rewards will roll-over into the next month's staking contract thus increasing the reward availability together with the amount of DEPAY eligible for those rewards for that month. This roll-over effect will not impact the planned APY for the respective month.

Illustrative Example:

Only 400k DEPAY will participate in the 100% APY December Stake & Earn program.

500k DEPAY rewards will stay unallocated

500k DEPAY rewards roll-over into the January Stake & Earn program (90% APY)

The January max. rewards increase from 360k to 860k

The allocatable DEPAY for January increases from 400k to 955k

All DEPAY rewards that remain unallocated when the Stake & Earn program terminates (30th September 2021) will be burnt.

What do I get for staking liquidity?

When you lock liquidity within our Stake & Earn program, DePay will reward you for helping us grow with up to 100% APY paid in DEPAY for the DEPAY portion of the staked liquidity.

Illustrative Example:

You stake your liquidity 1'000 DEPAY ($1.24) / 2.09668 ETH ($587), total value of $2'480 USD

It will be locked for 12 months, where you will continue to earn Uniswap fees of $711 USD/year (see the previous example)

Additionally, you will also earn 1'000 DEPAY ($1.24) worth $1'240 USD (at the time of writing) if staked in the 100% staking pool for 12 months

You will be able to unlock your liquidity and your DePay rewards 12 months after the commencement of the staking round together with all other participants within the associated round

In total, you will have thus earnt $711 USD from Uniswap fees PLUS $1’240 USD worth of DePay

$1’951 USD return on a $2’480 USD lock-in value over 12 months

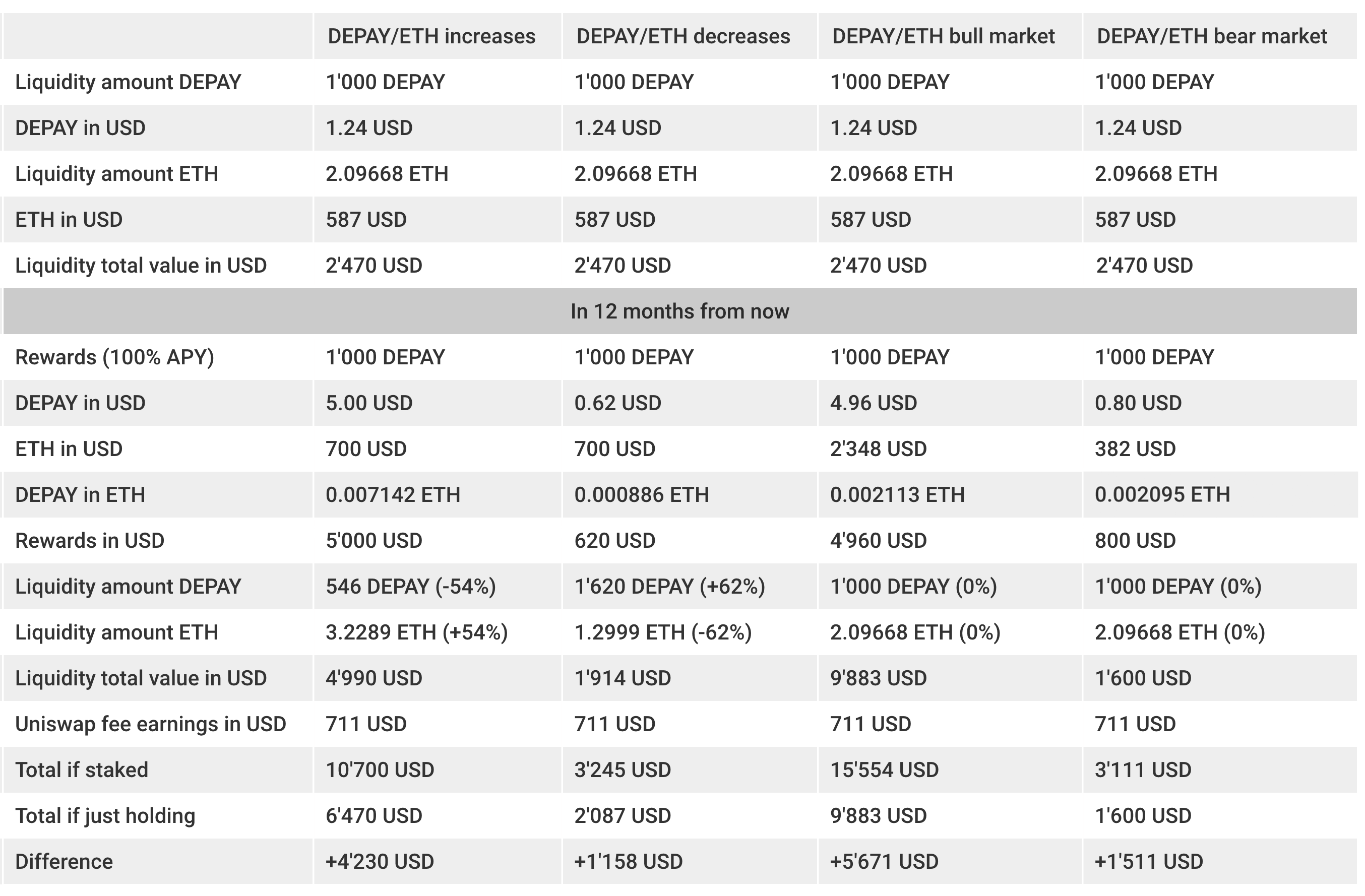

Illustrative examples of how staking could turn out

The below illustrates the potential outcome of four scenarios within the Stake & Earn program:

Price increases in both DEPAY and ETH, more significantly for DEPAY

ETH price increases and DEPAY price decreases

Significant increase in both DEPAY and ETH (bull market)

Significant decrease in both DEPAY and ETH (bear market)

Whilst staking rewards are fixed, the ratio of your staked DEPAY to ETH liquidity is not. To fully understand how Uniswap's automatic market maker mechanism works, please read the following "Understanding Returns" as published on the official Uniswap blog.

All following examples will utilize an initial 1'000 DEPAY lock-in amount and compare participating within the Stake & Earn program vs. just holding ("HODL") those 1'000 DEPAY.

📈 DEPAY vs. ETH price increases

You have 1'000 DEPAY

You stake liquidity 1'000 DEPAY ($1.24 USD/DEPAY) + 2.09668 ETH ($587 USD/ETH) totally worth $2'480 USD

You will earn 1'000 DEPAY ($1.24 USD) worth $1'240 USD at the time of writing if staked in the 100% staking pool for 12 months

In 12 months from now, DEPAY could be worth more ETH than when staking started

1 DEPAY is now worth $5.00 USD, ETH is $700 USD and 1 DEPAY is 0.007142 ETH (+240%)

Your rewards of 1'000 DEPAY will now be worth $5'000 USD

The amount of pooled DEPAY and ETH within the Uniswap liquidity pool changes due to the buying of DEPAY out of the pool, selling ETH into the pool in return, in line with Uniswaps automatic market maker algorithm

Your pooled liquidity now represents approx. 546 (-54%) DEPAY and 3.2289 (+54%) ETH worth a total of $4'990 USD given the shift in the pooled DEPAY/ETH ratio

You still earned approx. $711 USD from Uniswap exchange fees/yield over the 12 months staking period

Rewards plus total liquidity value plus Uniswap liquidity pool fees would total to approx. $10'700 USD

You've made $4'230 USD more staking DEPAY/ETH, compared to just holding your initial 1'000 DEPAY and 2.09668 ETH.

📉 DEPAY vs. ETH price decreases

You have 1'000 DEPAY

You stake liquidity 1'000 DEPAY ($1.24 USD/DEPAY) + 2.09668 ETH ($587 USD/ETH) totally worth $2'480 USD

You will earn 1'000 DEPAY ($1.24 USD) worth $1'240 USD at the time of writing if staked in the 100% staking pool for 12 months

In 12 months from now, DEPAY could be worth less ETH than when staking started

1 DEPAY is now worth $0.62 USD, ETH is $700 USD and 1 DEPAY is 0.000886 ETH (-57%)

Your rewards of 1'000 DEPAY will now be worth $620 USD

The amount of pooled DEPAY and ETH within the Uniswap liquidity pool changes due to the selling of DEPAY into the pool, buying ETH out of the pool in return, in line with Uniswaps automatic market maker algorithm

Your pooled liquidity now represents approx. 1'620 (+62%) DEPAY and 1.2999 (-62%) ETH worth a total of $1'914 USD given the shift in the pooled DEPAY/ETH ratio

You still earned approx. $711 USD from Uniswap exchange fees/yield over the 12 months staking period

Rewards plus total liquidity value plus Uniswap liquidity pool fees would total to approx. $3'245 USD

You've made $1'158 USD more staking DEPAY/ETH, compared to just holding your initial 1'000 DEPAY and 2.09668 ETH.

📈 DEPAY and ETH both increase - 🐮 Bull Market

You have 1'000 DEPAY

You stake liquidity 1'000 DEPAY ($1.24 USD/DEPAY) + 2.09668 ETH ($587 USD/ETH) totally worth $2'480 USD

You will earn 1'000 DEPAY ($1.24 USD) worth $1'240 USD at the time of writing if staked in the 100% staking pool for 12 months

In 12 months from now, DEPAY and ETH both could be worth more USD than when staking started

1 DEPAY is now worth $4.96 USD, ETH is $2'348 USD and 1 DEPAY is 0.002113 ETH (0% change)

Your rewards of 1'000 DEPAY will now be worth $4'960 USD

The amount of pooled DEPAY and ETH within the Uniswap liquidity pool grew constantly and in the same ratio 1:1

Your pooled liquidity still represents approx. 1'000 DEPAY and 2.09668 ETH worth a total of $9'883 USD

You still earned approx. $711 USD from Uniswap exchange fees/yield over the 12 months staking period

Rewards plus total liquidity value plus Uniswap liquidity pool fees would total to approx. $15'554 USD

You've made $5'670 USD more staking DEPAY/ETH, compared to just holding your initial 1'000 DEPAY and 2.09668 ETH.

📈 DEPAY and ETH both decrease - 🐻 Bear Market

You have 1'000 DEPAY

You stake liquidity 1'000 DEPAY ($1.24 USD/DEPAY) + 2.09668 ETH ($587 USD/ETH) totally worth $2'480 USD

You will earn 1'000 DEPAY ($1.24 USD) worth $1'240 USD at the time of writing if staked in the 100% staking pool for 12 months

In 12 months from now, DEPAY and ETH both could be worth less USD than when staking started

1 DEPAY is now worth $0.80 USD, ETH is $382 USD and 1 DEPAY is 0.002113 ETH (0% change)

Your rewards of 1'000 DEPAY will now be worth $800 USD

The amount of pooled DEPAY and ETH within the Uniswap liquidity pool decreased constantly and in the same ratio 1:1

Your pooled liquidity still represents approx. 1'000 DEPAY and 2.09668 ETH worth a total of $1'600 USD

You still earned approx. $711 USD from Uniswap exchange fees/yield over the 12 months staking period

Rewards plus total liquidity value plus Uniswap liquidity pool fees would total to approx. $3'111 USD

You've made $1'511 USD more staking DEPAY/ETH, compared to just holding your initial 1'000 DEPAY and 2.09668 ETH.

Audits?

For our liquidity staking smart contract, three independent external audits have been performed:

All issues identified together with suggested improvements from those audits have been incorporated into the liquidity staking smart contract.

Disclaimer: Please read and ensure that you fully understand the DePay disclaimer which also applies to our Stake & Earn program. The full disclaimer can be found within our Whitepaper, click here for details.